Within the monetary providers business, analysts want to change between structured knowledge (corresponding to time-series pricing data), unstructured textual content (corresponding to SEC filings and analyst stories), and audio/visible content material (earnings calls and shows). Every format requires totally different analytical approaches and specialised instruments, creating workflow inefficiencies. Add on prime of this the extraordinary time strain ensuing from quickly evolving business situations and slim choice home windows. Delayed evaluation can imply missed alternatives or failure to determine rising dangers, with probably important monetary penalties.

AI-assistants enhance productiveness by automating routine knowledge assortment and processing duties, surfacing related insights, and permitting analysts to deal with higher-value actions. Nonetheless, a single AI agent struggles with advanced, multistep funding analysis workflows to successfully deal with the complete spectrum of a number of specialised duties. That is the place multi-agent collaboration gives an development. By creating specialised AI subagents that excel in particular duties and functionalities and utilizing them collectively underneath a coordinated framework utilizing an AI supervisor agent, we will deal with the complete complexity of funding analysis workflows. A supervisor agent can intelligently decompose advanced queries, delegate specialised duties to subagents, and synthesize their outputs into complete solutions—just like how a analysis crew features in the true world. The advantages of this method are substantial, stemming from distributed problem-solving and specialization, improved accuracy by way of specialised experience, enhanced scalability by including new agent capabilities with out rebuilding the whole system, and larger transparency as a result of the reasoning course of of every specialised agent may be tracked and verified.

Amazon Bedrock Brokers makes use of the reasoning of basis fashions (FMs), APIs, and knowledge to interrupt down consumer requests, collect related data, and effectively full duties. With the multi-agent collaboration functionality of Amazon Bedrock, you may construct, deploy, and handle a number of AI brokers working collectively on advanced multistep duties that require specialised abilities. Amazon Bedrock Information Automation (BDA) permits the technology of helpful insights from unstructured multimodal content material corresponding to paperwork, photographs, audio, and video in your AI-powered functions, and it may be used as a parser when establishing a information base for Retrieval Augmented Technology (RAG) workflows.

On this submit, we stroll by way of the best way to construct a multi-agent funding analysis assistant utilizing the multi-agent collaboration functionality of Amazon Bedrock. Our answer demonstrates how a crew of specialised AI brokers can work collectively to investigate monetary information, consider inventory efficiency, optimize portfolio allocations, and ship complete funding insights—all orchestrated by way of a unified, pure language interface. We use BDA as a parser when establishing a information base for RAG workflows with multi-modal knowledge. Amazon Nova understanding fashions are used because the massive language fashions (LLMs) related to the supervisor brokers and subagents.

Test the video that demonstrates the answer,

Outcomes from these brokers are demonstrative, to not be taken as monetary recommendation.

Answer overview

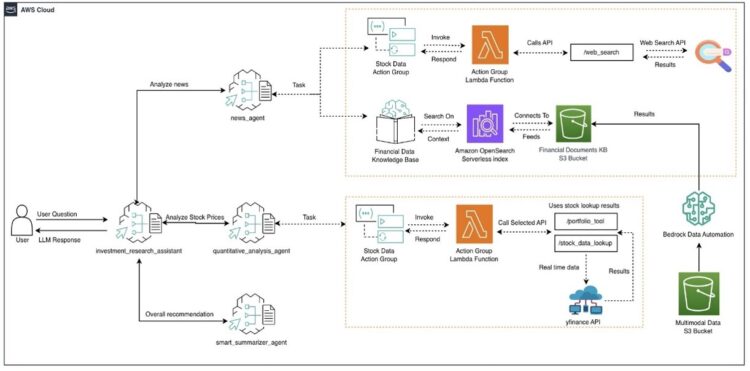

The multi-agent funding analysis assistant consists of a supervisor agent and three subagents (quantitative evaluation agent, information agent, and sensible summarizer agent) working collectively in a coordinated framework, as proven within the following diagram.

The supervisor agent makes use of the directions you present to grasp the construction and position of every collaborator agent. The supervisor agent orchestrates the general funding analysis course of by breaking down consumer prompts, delegating subtasks to specialised subagents, and consolidating their outputs to generate the ultimate response. Every subagent is configured to hold out specialised duties as follows:

- Quantitative evaluation agent

- Capabilities – Powered by stock-query and portfolio-optimization motion teams.

- Tasks – Question and analyze historic inventory knowledge and construct optimized portfolio allocations primarily based on consumer inputs corresponding to inventory tickers or funding quantity.

- Information agent

- Capabilities – Powered by the

web_searchmotion group and thefinancial_analysis_KBinformation base. - Tasks – Search and retrieve related monetary knowledge corresponding to earnings stories and filings from the information base for context. If data isn’t current within the information base, assemble an internet question. Handles queries associated to analyzing firm financials, efficiency drivers, and administration commentary.

- Capabilities – Powered by the

- Good summarizer agent

- Capabilities – Makes use of LLM capabilities with particular immediate directions, no customized motion group.

- Tasks – Takes in output from different subagents, corresponding to current information and monetary knowledge, and synthesizes the data into structured funding insights. Summarizes lengthy texts or paperwork corresponding to earnings stories into concise insights.

Multi-agent collaboration works as follows:

- Person prompts the multi-agent funding analysis assistant with a high-level analysis question.

- Supervisor agent breaks the question into subtasks and orchestrates and invokes the related subagents in parallel or sequentially as wanted:

- Information agent to retrieve monetary stories or knowledge

- Quantitative evaluation agent for inventory knowledge evaluation

- Good summarizer agent to summarize prolonged texts

- Supervisor agent consolidates the subagent outputs together with the unique question context.

- Supervisor agent passes the consolidated data to the LLM to generate the ultimate analysis insights.

This structure makes use of the strengths of the totally different specialised brokers to comprehensively deal with the varied facets of funding analysis, and the supervisor agent gives the clever orchestration.

Technical structure

The next diagram is the technical structure.

Among the key elements and the related codes of the technical structure are:

- Amazon Bedrock Information Automation (BDA) for processing knowledge – The next invokes a BDA job asynchronously utilizing the

invoke_data_automation_async()methodology from thebda-runtimeconsumer inboto3: - Defining and constructing subagents with instruments – The next creates a subagent utilizing

Agent.create.It defines two Lambda instruments—one for fetching historic inventory knowledge and one other for operating portfolio optimization—then registers them with the subagent together with its position, objective, directions, and the underlying FM.

- Defining and constructing the supervisor agent (multi-agent funding analysis assistant) – The next creates a supervisor agent utilizing

SupervisorAgent.create. It defines the collaborator brokers (subagents), and registers them with the supervisor agent together with its position, objective, directions, and the underlying FM. - Invoking the supervisor agent (multi-agent funding analysis assistant) – The next makes use of the

invokemethodology to cross within the outlined request as a immediate and get response from the supervisor agent, utilizing the multi-agent collaboration structure.

Stipulations

To deploy this answer, connect the suitable permissions for Amazon Bedrock, AWS Lambda, Amazon OpenSearch Serverless, Amazon Easy Storage Service (Amazon S3), and AWS Id and Entry Administration (IAM) to your execution position. You additionally must deploy two AWS CloudFormation stacks: web_search and stock_data.

For extra data on the permission coverage, CloudFormation stacks, and establishing the surroundings, check with the README.md within the investment_research_agent repository on GitHub.

Dive deeper into the answer

To dive deeper into the answer and the code proven on this submit, check with the funding analysis assistant agent GitHub repo. The repo comprises directions for the end-to-end answer, together with establishing the supervisor agent and subagents, related motion teams, unstructured knowledge (earnings stories PDF information and earnings name audio information), and structured knowledge (shares time collection).

Within the appendix on the finish of this submit, we share totally different questions requested by a monetary analyst to the supervisor agent, the subagent invoked, and the solutions from the supervisor agent.

Cleanup

To scrub up this answer, be sure that to delete all brokers, information bases, and related Amazon OpenSearch Serverless cases. Delete each the web_search and stock_data stacks. This may be sure that no expenses are incurred after you’re completed testing this answer. Learn the related pocket book within the GitHub repository for extra directions on cleansing up the brokers.

Conclusion

The multi-agent funding analysis assistant constructed utilizing Amazon Bedrock Brokers with its multi-agent collaboration function represents how monetary professionals can use AI to boost their analytical capabilities. Through the use of specialised brokers—every specializing in distinct facets of economic evaluation—orchestrated by a supervisor agent, we’ve created a system that may course of numerous knowledge varieties, apply acceptable analytical strategies, and synthesize complete insights in response to advanced funding queries. The result’s an AI assistant that may deal with multistep monetary evaluation workflows that will in any other case overwhelm a single-agent system.

The applying of multi-agent collaboration extends broadly throughout the monetary sector, from fairness analysis and portfolio administration to threat evaluation and compliance monitoring. A fancy monetary workflow that requires a number of specialised abilities and knowledge sources can profit from this architectural method.

The implementation makes use of key AWS providers, together with Amazon Bedrock for basis fashions, the multi-agent collaboration functionality of Amazon Bedrock Brokers, Amazon S3 for doc storage, Amazon OpenSearch Serverless for vector search capabilities, and Lambda features for specialised actions. This serverless structure gives scalability, and the information base integration gives context from monetary paperwork to floor the AI’s responses in factual knowledge.

For extra data:

- Get began constructing your individual multi-agent funding analysis assistant by accessing our full answer code and implementation information within the GitHub repo.

- Discover the best way to customise the answer in your particular funding analysis wants by modifying the subagents’ specialised instruments and motion teams and by bringing your knowledge securely to Amazon Bedrock Information Bases.

- You may also discover and run Amazon Bedrock multi-agent collaboration workshop with AWS specialists or by yourself.

Learn extra about single agent options for funding analysis with multi-modal knowledge:

Learn the weblog submit on Unlocking advanced problem-solving with multi-agent collaboration on Amazon Bedrock for extra particulars on advantages, design, and analysis of multi-agent collaboration for enterprise functions.

Concerning the Authors

Sovik Kumar Nath is an AI/ML and Generative AI senior answer architect with AWS. He has in depth expertise designing end-to-end machine studying and enterprise analytics options in finance, operations, advertising and marketing, healthcare, provide chain administration, and IoT. He has double masters levels from the College of South Florida, College of Fribourg, Switzerland, and a bachelors diploma from the Indian Institute of Expertise, Kharagpur. Exterior of labor, Sovik enjoys touring, taking ferry rides, and watching films.

Sovik Kumar Nath is an AI/ML and Generative AI senior answer architect with AWS. He has in depth expertise designing end-to-end machine studying and enterprise analytics options in finance, operations, advertising and marketing, healthcare, provide chain administration, and IoT. He has double masters levels from the College of South Florida, College of Fribourg, Switzerland, and a bachelors diploma from the Indian Institute of Expertise, Kharagpur. Exterior of labor, Sovik enjoys touring, taking ferry rides, and watching films.

Lucas Banerji is an AI/ML and GenAI specialist Options Architect at AWS. He’s captivated with constructing agentic AI programs and exploring the frontier of what’s doable with clever automation. Lucas holds a level in Pc Science from the College of Virginia. Exterior of labor, he enjoys operating, working towards Muay Thai, and touring the world.

Lucas Banerji is an AI/ML and GenAI specialist Options Architect at AWS. He’s captivated with constructing agentic AI programs and exploring the frontier of what’s doable with clever automation. Lucas holds a level in Pc Science from the College of Virginia. Exterior of labor, he enjoys operating, working towards Muay Thai, and touring the world.

Mohan Musti is a Principal Technical Account Manger primarily based out of Dallas. Mohan helps prospects architect and optimize functions on AWS. Mohan has Pc Science and Engineering from JNT College, India. In his spare time, he enjoys spending time together with his household and tenting.

Mohan Musti is a Principal Technical Account Manger primarily based out of Dallas. Mohan helps prospects architect and optimize functions on AWS. Mohan has Pc Science and Engineering from JNT College, India. In his spare time, he enjoys spending time together with his household and tenting.

Appendix

The next desk comprises instance questions requested and responses from the AI-powered assistant for funding analysis primarily based on structured and unstructured knowledge.

| Query Objective | Query requested by monetary analyst to AI-powered assistant | Subagent, motion group and/or information base invoked | Intermediate steps from Supervisor agent chain-of-thought reasoning | Multi-agent Funding Analysis Assistant – Responses |

| Immediate the agent to investigate the corporate’s monetary well being and efficiency. | Analyze Amazon’s monetary well being primarily based on the 2024 10k report. Calculate vital monetary ratios. Restrict to five sentences. | news_agent (financial_analysis_kb), smart_summarizer_agent | 1) I must particularly request the 2024 10-Okay report data from the information base. Let me ask the information agent for this particular report. 2) For the reason that information base comprises current monetary data and forward-looking steerage, I’ll present a complete abstract of Amazon’s monetary metrics and projections. 3) Now I’ll ask the analyst agent to investigate this data and calculate key monetary ratios. |

Primarily based on Amazon’s current monetary knowledge, the corporate demonstrates sturdy monetary well being with whole property of $624.9B and a strong money place of $78.8B, whereas producing $143.3B in web gross sales and $59.2B in web revenue. Key profitability metrics present enchancment with a 46% gross margin, 4.4% working margin, and 14.8% return on fairness, whereas effectivity ratios stay wholesome with stock turnover at 13.2x and asset turnover at 1.4x. Liquidity ratios (present ratio: 1.06, fast ratio: 0.88) are enough although tight, however are supported by sturdy working money stream of $54.3B, representing a 38% year-over-year enhance. The corporate maintains a balanced leverage profile with a debt-to-equity ratio of 0.98 and stable curiosity protection ratio of 8.5x, indicating good debt administration. Regardless of ongoing excessive capital expenditures, Amazon’s enhancing margins, sturdy money technology, and environment friendly operations counsel a wholesome monetary place with sustainable progress potential. |

| Immediate the agent to investigate the corporate’s monetary efficiency from firm’s earnings stories | What have been the primary drivers of AWS’s income progress within the Q1 2023 quarter? Please restrict your solutions to five sentences. | news_agent (financial_analysis_kb), smart_summarizer_agent | 1.) I must get details about AWS’s Q1 2023 earnings report. I’ll ask the information agent to verify the information base for this particular data. 2.) Primarily based on the search outcomes, I can present a complete reply about AWS’s Q1 2023 efficiency and progress drivers. The knowledge comes immediately from their earnings stories. 3.) I’ll synthesize this data right into a concise response specializing in the primary drivers and ship it to the consumer. |

AWS’s Q1 2023 income progress was primarily pushed by continued cloud adoption, attaining web gross sales of $21.4 billion and a 16% year-over-year progress charge. Nonetheless, the expansion was tempered by prospects throughout all segments optimizing their cloud spending in response to financial uncertainty. The enterprise maintained sturdy fundamentals with an annualized gross sales run charge exceeding $85 billion, although momentum confirmed indicators of slowing with April progress charges declining by roughly 500 foundation factors in comparison with Q1. |

| Immediate the agent to investigate the corporate’s administration crew and their plans for the longer term from firm’s earnings stories | What are Amazon’s prime priorities for 2024? What are the most important dangers going through the corporate? Please restrict your solutions to five sentences. | news_agent (financial_analysis_kb & web_search), smart_summarizer_agent | 1.) I’ll ask the information agent to verify the information base for current details about Amazon’s strategic priorities and threat elements for 2024. 2.) Let me get further current information and threat elements by asking the information agent to seek for supplementary data. 3.) Primarily based on the current information searches, I can now present a complete overview of the numerous dangers presently going through Amazon |

Amazon’s prime priorities for 2024 embody increasing worldwide shops, rising grocery and B2B retail segments, scaling the “Purchase with Prime” program, advancing healthcare initiatives, and creating low Earth orbit satellite tv for pc capabilities for improved connectivity. The corporate faces a number of important dangers, together with substantial AI-related capital expenditure pressures (anticipated $75 billion in 2024), growing regulatory scrutiny from the FTC and competitors authorities, potential impacts from new Chinese language import tariffs, and intensifying competitors in each cloud computing and retail sectors. Amazon is balancing these formidable progress initiatives with price optimization efforts, whereas viewing their strategic investments as probably transformative for his or her long-term future. |

| Immediate the agent to construct an optimum portfolio utilizing the collected knowledge | Optimize my portfolio with AAA, BBB, and CCC [anonymized tickers] | quantitative_analysis_agent (stock_data_lookup & portfolio device) | 1.) I must get historic inventory knowledge for these three shares earlier than operating portfolio optimization. I’ll ask the inventory knowledge agent for this data. 2.) Now that I’ve retrieved the historic value knowledge for all three shares, I’ll carry out portfolio optimization utilizing this knowledge. 3.) I’ll synthesize this data into a transparent, complete response for the consumer. |

Primarily based on portfolio optimization evaluation, right here is the really useful allocation: Firm A (AAA): 61.04% Firm B (BBB): 32.54% Firm C (CCC): 6.42% This allocation optimizes risk-adjusted returns primarily based on current market knowledge. Please notice that these allocations are primarily based on mathematical optimization and historic knowledge. Think about your private funding targets, threat tolerance, and market situations when making funding choices. |

| Immediate the agent to lookup information and relate it to inventory knowledge | What was occurring to AMZN inventory in November 2024, relate that to information in the identical timeframe | news_agent (web_search), quantitative_analysis_agent (stock_data_lookup), & smart_summarizer_agent | 1.) I’ll must get each current inventory value knowledge and information, then synthesize them collectively. I’ll request each concurrently to be environment friendly. 2.) I’ll now synthesize the inventory value motion with the current information developments to supply a complete evaluation. |

November 2024: Inventory Value Motion: – Buying and selling Vary: $161.43 (low) to $206.21 (excessive) – Total Pattern: Vital upward momentum with notable volatility – Key Technical Ranges: Resistance at $206, Help at $190. Key Information Impression: 1. This autumn 2024 Steerage (Launched Oct 31): – Projected web gross sales: $181.5-188.5 billion – Anticipated progress: 7-11% year-over-year – This steerage served as a significant catalyst for the inventory’s motion Value-Information Correlation: – The sturdy upward motion (~27% vary) seems to be primarily pushed by optimistic This autumn steerage – Investor confidence was bolstered by the projected gross sales progress – The large steerage vary mirrored optimism across the vacation purchasing season – Greater buying and selling volumes have been noticed throughout value actions, indicating sturdy market participation The inventory’s efficiency means that traders responded positively to Amazon’s forward-looking steerage, significantly relating to vacation season expectations. The volatility in value actions signifies energetic buying and selling round these information occasions, with the market usually sustaining an optimistic outlook on Amazon’s near-term prospects. |