The Amazon Bedrock multi-agent collaboration characteristic provides builders the flexibleness to create and coordinate a number of AI brokers, every specialised for particular duties, to work collectively effectively on advanced enterprise processes. This allows seamless dealing with of subtle workflows via agent cooperation. This put up goals to exhibit the applying of a number of specialised brokers inside the Amazon Bedrock multi-agent collaboration functionality, particularly specializing in their utilization in numerous elements of monetary evaluation. By showcasing this implementation, we hope as an instance the potential of utilizing numerous, task-specific brokers to reinforce and streamline monetary decision-making processes.

The function of monetary assistant

This put up explores a monetary assistant system that focuses on three key duties: portfolio creation, firm analysis, and communication.

Portfolio creation begins with an intensive evaluation of person necessities, the place the system determines particular standards such because the variety of firms and trade focus. These parameters allow the system to create personalized firm portfolios and format the data based on standardized templates, sustaining consistency and professionalism.

For firm analysis, the system conducts in-depth investigations of portfolio firms and collects important monetary and operational information. It may well retrieve and analyze Federal Open Market Committee (FOMC) studies whereas offering data-driven insights on financial traits, firm monetary statements, Federal Reserve assembly outcomes, and trade analyses of the S&P 500 and NASDAQ.

By way of communication and reporting, the system generates detailed firm monetary portfolios and creates complete income and expense studies. It effectively manages the distribution of automated studies and handles stakeholder communications, offering correctly formatted emails containing portfolio data and doc summaries that attain their meant recipients.

The usage of a multi-agent system, reasonably than counting on a single giant language mannequin (LLM) to deal with all duties, permits extra centered and in-depth evaluation in specialised areas. This put up goals as an instance using a number of specialised brokers inside the Amazon Bedrock multi-agent collaboration functionality, with specific emphasis on their software in monetary evaluation.

This implementation demonstrates the potential of utilizing numerous, task-specific brokers to enhance and simplify monetary decision-making processes. Utilizing a number of brokers permits the parallel processing of intricate duties, together with regulatory compliance checking, threat evaluation, and trade evaluation, whereas sustaining clear audit trails and accountability. These superior capabilities can be troublesome to realize with a single LLM system, making the multi-agent method more practical for advanced monetary operations and routing duties.

Overview of Amazon Bedrock multi-agent collaboration

The Amazon Bedrock multi-agent collaboration framework facilitates the event of subtle methods that use LLMs. This structure demonstrates the numerous benefits of deploying a number of specialised brokers, every designed to deal with distinct elements of advanced duties reminiscent of monetary evaluation.

The multi-collaboration framework permits hierarchical interplay amongst brokers, the place prospects can provoke agent collaboration by associating secondary agent collaborators with a major agent. These secondary brokers might be any agent inside the identical account, together with these possessing their very own collaboration capabilities. Due to this versatile, composable sample, prospects can assemble environment friendly networks of interconnected brokers that work seamlessly collectively.

The framework helps two distinct forms of collaboration:

- Supervisor mode – On this configuration, the first agent receives and analyzes the preliminary request, systematically breaking it down into manageable subproblems or reformulating the issue assertion earlier than partaking subagents both sequentially or in parallel. The first agent also can seek the advice of connected information bases or set off motion teams earlier than or after subagent involvement. Upon receiving responses from secondary brokers, the first agent evaluates the outcomes to find out whether or not the issue has been adequately resolved or if extra actions are needed.

- Router and supervisor mode – This hybrid method begins with the first agent trying to route the request to probably the most acceptable subagent.

- For simple inputs, the first agent directs the request to a single subagent and relays the response on to the person.

- When dealing with advanced or ambiguous inputs, the system transitions to supervisor mode, the place the first agent both decomposes the issue into smaller parts or initiates a dialogue with the person via follow-up questions, following the usual supervisor mode protocol.

Use Amazon Bedrock multi-agent collaboration to energy the monetary assistant

The implementation of a multi-agent method provides quite a few compelling benefits. Primarily, it permits complete and complex evaluation via specialised brokers, every devoted to their respective domains of experience. This specialization results in extra sturdy funding selections and minimizes the chance of overlooking important trade indicators.

Moreover, the system’s modular structure facilitates seamless upkeep, updates, and scalability. Organizations can improve or substitute particular person brokers with superior information sources or analytical methodologies with out compromising the general system performance. This inherent flexibility is crucial in in the present day’s dynamic and quickly evolving monetary industries.

Moreover, the multi-agent framework demonstrates distinctive compatibility with the Amazon Bedrock infrastructure. By deploying every agent as a discrete Amazon Bedrock element, the system successfully harnesses the answer’s scalability, responsiveness, and complex mannequin orchestration capabilities. Finish customers profit from a streamlined interface whereas the advanced multi-agent workflows function seamlessly within the background. The modular structure permits for easy integration of latest specialised brokers, making the system extremely extensible as necessities evolve and new capabilities emerge.

Answer overview

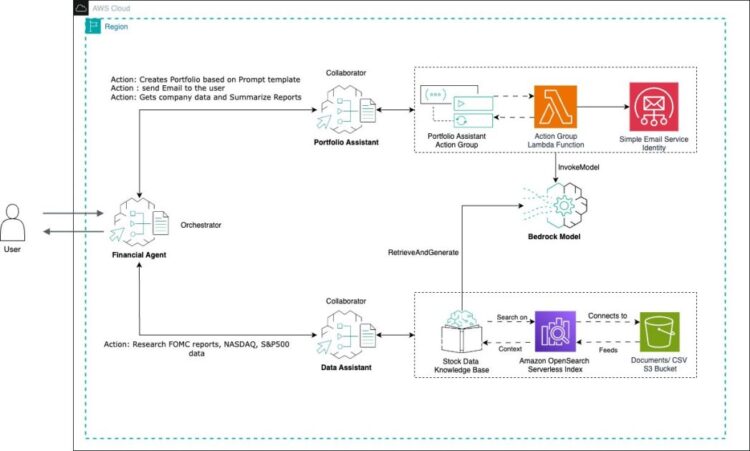

On this answer, we implement a three-agent structure comprising of 1 supervisor agent and two collaborator brokers. When a person initiates an funding report request, the system orchestrates the execution throughout particular person brokers, facilitating the mandatory information trade between them. Amazon Bedrock effectively manages the scheduling and parallelization of those duties, selling well timed completion of your entire course of.

The monetary agent serves as the first supervisor and central orchestrator, coordinating operations between specialised brokers and managing the general workflow. This agent additionally handles outcome presentation to customers. Consumer interactions are solely channeled via the monetary agent via invoke_agent calls. The answer incorporates two specialised collaborator brokers:

The portfolio assistant agent performs the next key capabilities:

- Creates a portfolio with static information that’s current with the agent for firms and makes use of this to create detailed income particulars and different particulars for the previous yr

- Stakeholder communication administration via electronic mail

The information assistant agent capabilities as an data repository and information retrieval specialist. Its major duties embody:

- Offering data-driven insights on financial traits, firm monetary statements, and FOMC paperwork

- Processing and responding to person queries concerning monetary information reminiscent of earlier yr income and stakeholder paperwork of the corporate for each fiscal quarter. That is merely static information for experimentation; nevertheless, we will stream the real-time information utilizing accessible APIs.

The information assistant agent maintains direct integration with the Amazon Bedrock information base, which was initially populated with ingested monetary doc PDFs as detailed on this put up.

The general diagram of the multi-agent system is proven within the following diagram.

This multi-agent collaboration integrates specialised experience throughout distinct brokers, delivering complete and exact options tailor-made to particular person necessities. The system’s modular structure facilitates seamless updates and agent modifications, enabling clean integration of latest information sources, analytical methodologies, and regulatory compliance updates. Amazon Bedrock supplies sturdy help for deploying and scaling these multi-agent monetary methods, sustaining high-performance mannequin execution and orchestration effectivity. This architectural method not solely enhances funding evaluation capabilities but in addition maximizes the utilization of Amazon Bedrock options, leading to an efficient answer for monetary evaluation and complicated information processing operations. Within the following sections, we exhibit the step-by-step means of developing this multi-agent system. Moreover, we offer entry to a repository (hyperlink forthcoming) containing the entire codebase needed for implementation.

Conditions

Earlier than implementing the answer, be sure you have the next stipulations in place:

- Create an Amazon Easy Storage Bucket (Amazon S3) bucket in your most well-liked Area (for instance,

us-west-2) with the designation financial-data-101.To observe alongside, you possibly can obtain our check dataset, which incorporates each publicly accessible and synthetically generated information, from the next hyperlink. Software integration might be carried out following the identical method demonstrated on this instance. Observe that extra paperwork might be included to reinforce your information assistant agent’s capabilities. The aforementioned paperwork function illustrative examples. - Allow mannequin entry for Amazon Titan and Amazon Nova Lite. Be sure to make use of the identical Area for mannequin entry because the Area the place you construct the brokers.

These fashions are important parts for the event and testing of your Amazon Bedrock information base.

Construct the info assistant agent

To ascertain your information base, observe these steps:

- Provoke a information base creation course of in Amazon Bedrock and incorporate your information sources by following the rules in Create a information base in Amazon Bedrock Information Bases.

- Arrange your information supply configuration by deciding on Amazon S3 as the first supply and selecting the suitable S3 bucket containing your paperwork.

- Provoke synchronization. Configure your information synchronization by establishing the connection to your S3 supply. For the embedding mannequin configuration, choose Amazon: Titan Embeddings—Textual content whereas sustaining default parameters for the remaining choices.

- Evaluate all alternatives rigorously on the abstract web page earlier than finalizing the information base creation, then select Subsequent. Keep in mind to notice the information base title for future reference.

The constructing course of may take a number of minutes. Make it possible for it’s full earlier than continuing.

Upon completion of the information base setup, manually create a information base agent:

- To create the information base agent, observe the steps at Create and configure agent manually within the Amazon Bedrock documentation. Throughout creation, implement the next instruction immediate:

Make the most of this information base when responding to queries about information, together with financial traits, firm monetary statements, FOMC assembly outcomes, SP500, and NASDAQ indices. Responses needs to be strictly restricted to information base content material and help in agent orchestration for information provision.

- Preserve default settings all through the configuration course of. On the agent creation web page, within the Information Base part, select Add.

- Select your beforehand created information base from the accessible choices within the dropdown menu.

Construct the portfolio assistant agent

The bottom agent is designed to execute particular actions via outlined motion teams. Our implementation at the moment incorporates one motion group that manages portfolio-related operations.

To create the portfolio assistant agent, observe the steps at Create and configure agent manually.

The preliminary step entails creating an AWS Lambda operate that can combine with the Amazon Bedrock agent’s CreatePortfolio motion group. To configure the Lambda operate, on the AWS Lambda console, set up a brand new operate with the next specs:

- Configure Python 3.12 because the runtime atmosphere

- Arrange operate schema to reply to agent invocations

- Implement backend processing capabilities for portfolio creation operations

- Combine the implementation code from the designated GitHub repository for correct performance with the Amazon Bedrock agent system

This Lambda operate serves because the request handler and executes important portfolio administration duties as specified within the agent’s motion schema. It comprises the core enterprise logic for portfolio creation options, with the entire implementation accessible within the referenced Github repository.

Use this advisable schema when configuring the motion group response format in your Lambda operate within the portfolio assistant agent:

After creating the motion group, the following step is to change the agent’s base directions. Add these things to the agent’s instruction set:

Within the Multi-agent collaboration part, select Edit. Add the information base agent as a supervisor-only collaborator, with out together with routing configurations.

To confirm correct orchestration of our specified schema, we’ll leverage the superior prompts characteristic of the brokers. This method is important as a result of our motion group adheres to a particular schema, and we have to present seamless agent orchestration whereas minimizing hallucination attributable to default parameters. Via the implementation of immediate engineering strategies, reminiscent of chain of thought prompting (CoT), we will successfully management the agent’s habits and ensure it follows our designed orchestration sample.

In Superior prompts, add the next immediate configuration at traces 22 and 23:

The answer makes use of Amazon Easy E-mail Service (Amazon SES) with the AWS SDK for Python (Boto3) within the portfoliocreater Lambda operate to ship emails. To configure Amazon SES, observe the steps at Ship an E-mail with Amazon SES documentation.

Construct the supervisor agent

The supervisor agent serves as a coordinator and delegator within the multi-agent system. Its major duties embody job delegation, response coordination, and managing routing via supervised collaboration between brokers. It maintains a hierarchical construction to facilitate interactions with the portfolioAssistant and DataAgent, working collectively as an built-in staff.

Create the supervisor agent following the steps at Create and configure agent manually. For agent directions, use the similar immediate employed for the portfolio assistant agent. Append the next line on the conclusion of the instruction set to suggest that it is a collaborative agent:

On this part, the answer modifies the orchestration immediate to higher go well with particular wants. Use the next because the personalized immediate:

Within the Multi-agent part, add the beforehand created brokers. Nevertheless, this time designate a supervisor agent with routing capabilities. Deciding on this supervisor agent implies that routing and supervision actions will probably be tracked via this agent while you study the hint.

Demonstration of the brokers

To check the agent, observe these steps. Preliminary setup requires establishing collaboration:

- Open the monetary agent (major agent interface)

- Configure collaboration settings by including secondary brokers. Upon finishing this configuration, system testing can begin.

Save and put together the agent, then proceed with testing.

Have a look at the check outcomes:

Analyzing the session summaries reveals that the info is being retrieved from the collaborator agent.

The brokers exhibit efficient collaboration when processing prompts associated to NASDAQ information and FOMC studies established within the information base.

For those who’re fascinated by studying extra in regards to the underlying mechanisms, you possibly can select Present hint, to watch the specifics of every stage of the agent orchestration.

Conclusion

Amazon Bedrock multi-agent methods present a robust and versatile framework for monetary AI brokers to coordinate advanced duties. Monetary establishments can deploy groups of specialised AI brokers that seamlessly resolve advanced issues reminiscent of threat evaluation, fraud detection, regulatory compliance, and guardrails utilizing Amazon Bedrock basis fashions and APIs. The monetary trade is changing into extra digital and data-driven, and Amazon Bedrock multi-agent methods are a cutting-edge method to make use of AI. These methods allow seamless coordination of numerous AI capabilities, serving to monetary establishments resolve advanced issues, innovate, and keep forward in a quickly altering world financial system. With extra improvements reminiscent of device calling we will make use of the multi-agents and make it extra sturdy for advanced situations the place absolute precision is important.

Concerning the Authors

Suheel is a Principal Engineer in AWS Help Engineering, specializing in Generative AI, Synthetic Intelligence, and Machine Studying. As a Topic Matter Professional in Amazon Bedrock and SageMaker, he helps enterprise prospects design, construct, modernize, and scale their AI/ML and Generative AI workloads on AWS. In his free time, Suheel enjoys figuring out and mountaineering.

Suheel is a Principal Engineer in AWS Help Engineering, specializing in Generative AI, Synthetic Intelligence, and Machine Studying. As a Topic Matter Professional in Amazon Bedrock and SageMaker, he helps enterprise prospects design, construct, modernize, and scale their AI/ML and Generative AI workloads on AWS. In his free time, Suheel enjoys figuring out and mountaineering.

Qingwei Li is a Machine Studying Specialist at Amazon Internet Providers. He obtained his Ph.D. in Operations Analysis after he broke his advisor’s analysis grant account and did not ship the Nobel Prize he promised. At present he helps prospects within the monetary service and insurance coverage trade construct machine studying options on AWS. In his spare time, he likes studying and educating.

Qingwei Li is a Machine Studying Specialist at Amazon Internet Providers. He obtained his Ph.D. in Operations Analysis after he broke his advisor’s analysis grant account and did not ship the Nobel Prize he promised. At present he helps prospects within the monetary service and insurance coverage trade construct machine studying options on AWS. In his spare time, he likes studying and educating.

Aswath Ram A. Srinivasan is a Cloud Help Engineer at AWS. With a robust background in ML, he has three years of expertise constructing AI purposes and focuses on {hardware} inference optimizations for LLM fashions. As a Topic Matter Professional, he tackles advanced situations and use instances, serving to prospects unblock challenges and speed up their path to production-ready options utilizing Amazon Bedrock, Amazon SageMaker, and different AWS providers. In his free time, Aswath enjoys pictures and researching Machine Studying and Generative AI.

Aswath Ram A. Srinivasan is a Cloud Help Engineer at AWS. With a robust background in ML, he has three years of expertise constructing AI purposes and focuses on {hardware} inference optimizations for LLM fashions. As a Topic Matter Professional, he tackles advanced situations and use instances, serving to prospects unblock challenges and speed up their path to production-ready options utilizing Amazon Bedrock, Amazon SageMaker, and different AWS providers. In his free time, Aswath enjoys pictures and researching Machine Studying and Generative AI.

Girish Krishna Tokachichu is a Cloud Engineer (AI/ML) at AWS Dallas, specializing in Amazon Bedrock. Obsessed with Generative AI, he helps prospects resolve challenges of their AI workflows and builds tailor-made options to fulfill their wants. Outdoors of labor, he enjoys sports activities, health, and touring.

Girish Krishna Tokachichu is a Cloud Engineer (AI/ML) at AWS Dallas, specializing in Amazon Bedrock. Obsessed with Generative AI, he helps prospects resolve challenges of their AI workflows and builds tailor-made options to fulfill their wants. Outdoors of labor, he enjoys sports activities, health, and touring.