Underwriting is a elementary perform inside the insurance coverage business, serving as the muse for threat evaluation and administration. Underwriters are chargeable for evaluating insurance coverage functions, figuring out the extent of threat related to every applicant, and making choices on whether or not to simply accept or reject the appliance based mostly on the insurer’s tips and threat urge for food.

On this put up, we focus on the right way to use AWS generative synthetic intelligence (AI) options like Amazon Bedrock to enhance the underwriting course of, together with rule validation, underwriting tips adherence, and determination justification. We’ve additionally supplied an accompanying GitHub repo so you may strive the answer.

The underwriting course of usually entails a number of key steps:

- Gathering and verifying info – Underwriters accumulate and assessment varied information factors in regards to the applicant, corresponding to age, well being standing, occupation, and life-style habits for all times insurance coverage, or property location, building kind, and security options for property insurance coverage

- Threat evaluation – Underwriters analyze the potential threat of insuring the applicant utilizing statistical fashions, actuarial information, and their very own experience

- Premium dedication – Based mostly on the danger evaluation, underwriters calculate the suitable premium for the specified protection, aiming to strike a steadiness between aggressive pricing and guaranteeing the insurer’s profitability

- Coverage customization – Underwriters might tailor insurance coverage insurance policies to fulfill the particular wants of candidates whereas aligning with the insurer’s threat administration technique

- Choice-making – After assessing the danger and figuring out the suitable premium, underwriters determine whether or not to simply accept or reject the appliance

Efficient underwriting is essential for the monetary stability and profitability of insurance coverage corporations. By precisely assessing threat and setting applicable premiums, underwriters assist insurers keep a balanced threat portfolio and keep away from opposed choice of potential coverage holders.

Challenges in doc understanding for underwriting

Doc understanding is a important and sophisticated side of the underwriting course of that poses vital challenges for insurers. Underwriters should assessment and analyze a variety of paperwork submitted by candidates, and the guide extraction of related info is a time-consuming and error-prone job. The challenges in doc understanding will be broadly categorized into three areas:

- Rule validation – Verifying that the knowledge supplied within the paperwork adheres to the insurer’s underwriting tips. It is a advanced job when confronted with unstructured information, various doc codecs, and misguided information.

- Underwriting tips adherence – Persistently making use of the insurer’s underwriting tips throughout all choices is essential for sustaining equity and regulatory compliance. Nevertheless, guide interpretation can result in inconsistencies and potential human bias. Additionally, inconsistent information can result in flawed rule functions, particularly when coping with giant volumes of data.

- Choice justification – Offering clear and concise explanations for underwriting choices, particularly in circumstances the place an utility is denied or provided modified phrases or exceptions. This may be time-consuming and should lack the mandatory readability and objectivity.

The influence of those challenges on the underwriting course of is critical. Guide information extraction and evaluation can decelerate the workflow, resulting in longer processing occasions and decrease buyer retention. Errors in information interpretation or inconsistencies in making use of tips can lead to incorrect threat assessments, premium leakage, and misplaced prospects for the insurer.

To handle these challenges, insurers are more and more turning to superior applied sciences corresponding to machine studying, pure language processing, and clever doc processing options.

Nevertheless, implementing these applied sciences has been difficult for carriers. Constructing guidelines and pipelines for every doc or insurance coverage product might require devoted groups, material experience in new applied sciences, and safety and compliance controls. Moreover, conventional approaches lack contextual understanding that include underwriting, inflicting fragility in current options. Within the subsequent part, we discover how generative AI and Amazon Bedrock can assist insurers overcome these challenges and streamline the underwriting course of by means of clever doc understanding and automation.

How generative AI and Amazon Bedrock assist resolve these challenges

One of many key benefits of generative AI is its capability to know and interpret context inside paperwork. Not like conventional rule-based programs that depend on strict sample matching, generative AI fashions can grasp the nuances and semantics of language, permitting them to extract significant insights even from advanced and diverse doc codecs. This contextual understanding is especially helpful in underwriting, the place the interpretation of data usually requires domain-specific data and reasoning.

Amazon Bedrock is a completely managed service that gives a alternative of high-performing basis fashions (FMs) from main AI corporations like AI21 Labs, Anthropic, Cohere, Meta, Mistral AI, Stability AI, and Amazon by means of a single API, together with a broad set of capabilities to construct generative AI functions with safety, privateness, and accountable AI.

Amazon Bedrock simplifies the deployment, scaling, implementation, and administration of generative AI fashions for insurers. With Amazon Bedrock, insurers can simply combine pre-trained fashions or custom-built fashions into their current underwriting workflows and programs, with out the necessity for intensive ML experience or infrastructure administration. Utilizing the ability of AI to automate tedious and time-consuming duties allows underwriters to concentrate on their core competencies.

To equip FMs with up-to-date and proprietary info, corresponding to underwriting manuals, you need to use Retrieval Augmented Technology (RAG), a method that fetches information from firm information sources and enriches the immediate to offer extra related and correct responses. Information Bases for Amazon Bedrock is a completely managed functionality that helps you implement the complete RAG workflow, from ingestion to retrieval and immediate augmentation, with out having to construct {custom} integrations to information sources and handle information flows.

On this answer, we use the data base functionality provided by Amazon Bedrock to boost the reasoning and decision-making strategy of the generative AI fashions. Information Bases for Amazon Bedrock permits us to ingest and incorporate related underwriting tips and manuals into the fashions’ data base. Information Bases for Amazon Bedrock simplifies the mixing course of by eliminating the necessity for {custom} integrations with information sources and the administration of advanced information flows. It streamlines the ingestion and retrieval of underwriting manuals, so fashions have entry to essentially the most present and related info. We are able to fetch particular info from the ingested underwriting manuals and enrich the prompts supplied to the fashions. This makes certain the fashions have entry to essentially the most up-to-date and related info, enabling them to offer extra correct and context-aware responses. Information Bases for Amazon Bedrock gives a vital benefit by permitting insurers to infuse their proprietary area data and underwriting insurance policies into the generative AI fashions. This empowers the fashions to make choices which might be totally aligned with the insurer’s threat administration methods, tips, and regulatory necessities.

Generative AI and Amazon Bedrock can handle particular challenges in doc understanding for underwriting:

- Rule validation – Generative AI fashions can robotically validate the knowledge supplied in utility paperwork in opposition to an insurer’s underwriting tips. Through the use of strategies like RAG or in-context prompting, these fashions can extract related info from paperwork and evaluate it in opposition to predefined guidelines, flagging any discrepancies or non-compliance. This reduces the danger of errors and gives consistency within the underwriting course of.

- Underwriting tips adherence – Generative AI allows insurers to embed their underwriting tips straight into the prompts or directions supplied to the fashions. By engineering these prompts, insurers can align their AI-driven decision-making course of with the corporate’s threat administration technique. This method minimizes inconsistencies and potential bias in underwriting choices.

- Choice justification – Generative AI fashions can generate clear and concise explanations for underwriting choices, offering transparency and objectivity within the course of. These fashions can articulate the reasoning behind every determination based mostly on the knowledge extracted from paperwork and the insurer’s tips, together with the supply paperwork utilized in its determination. This makes it simple for underwriters to assessment predications, and improves communication with candidates, auditors, and regulators.

By adopting generative AI and Amazon Bedrock, insurers can improve underwriting effectivity, cut back processing occasions, decrease errors, adhere to equity and regulatory compliance, and enhance transparency and buyer satisfaction. On this put up, we present a easy use case of validating paperwork in opposition to a set of underwriting tips, and in future posts, we are going to present extra advanced situations throughout a big corpus of paperwork, and extra superior underwriting guidelines.

Answer overview

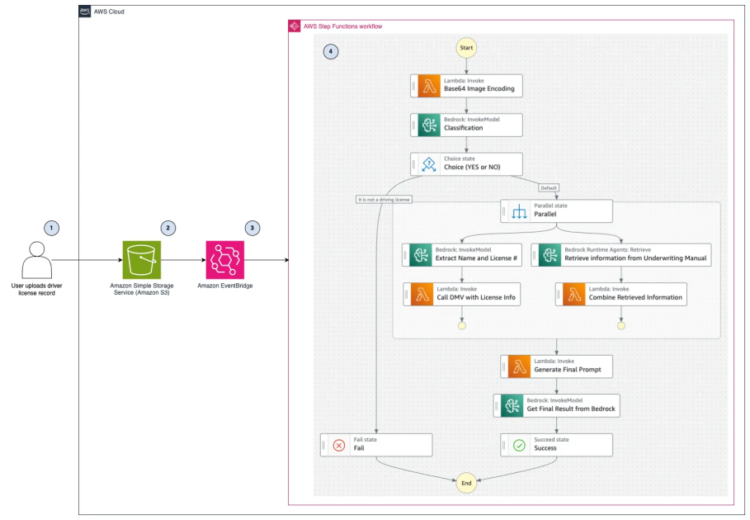

The next diagram illustrates the automated course of for verifying driver’s license information and validating underwriting guidelines utilizing varied AWS providers.

The answer contains the next steps:

- Customers add a picture of a driver’s license document to an Amazon Easy Storage Service (Amazon S3) bucket. The bucket is configured to ship occasion notifications to Amazon EventBridge.

- An EventBridge rule is configured to begin an AWS Step Features state machine when objects are uploaded to the S3 bucket.

- EventBridge sends the occasion information to the Step Features workflow, which can orchestrate a number of AWS providers to carry out the required duties for underwriting guidelines validation.

- The state machine begins and runs a sequence of event-driven steps:

- The workflow begins with the “Base64 Picture Encoding” state, which encodes a picture of the uploaded driver’s license into Base64 format.

- The Base64 encoding is then handed to the “Classification” state, which invokes Anthropic Claude 3 Haiku on Amazon Bedrock to categorise the picture as a driver’s license.

- Based mostly on the classification end result, the workflow decides whether or not to proceed utilizing the “Alternative (YES or NO)” state.

- If categorised as a driver’s license, the workflow proceeds to the “Parallel” state to run two Amazon Bedrock duties in parallel. If not categorised as a driver’s license, the workflow will fail.

- Beneath the “Parallel” state, two duties are run concurrently:

- The primary job proceeds to the “Extract Title and License #” workflow state, which makes use of Amazon Bedrock to invoke Anthropic Claude 3 Haiku to extract the title and the motive force’s license quantity from the picture. The title and the license quantity are then handed to an AWS Lambda perform “Name DMV API with License Information” state, which integrates with the related Division of Motor Autos (DMV) API to retrieve the driving document.

- The second job below the “Parallel” state performs a “Retrieve Info from Underwriting Guide” motion to acquire the underwriting guidelines relevant for a driver to get insurance coverage.

- The retrieved underwriting guidelines info is then handed to Lambda perform “Mix Retrieved info” to compile below the identical physique of textual content all of the related guidelines to be validated.

- The ultimate step contains two duties: the Lambda perform “Generate Ultimate Immediate” creates the immediate for use to carry out the verification in opposition to the underwriting guide, contemplating additionally the driving document report, which is then used to invoke an Amazon Bedrock mannequin below the state “Get Ultimate Consequence from Bedrock,” which generates the ultimate report with the foundations validation and suggestions.

By combining these AWS providers and benefiting from the capabilities of the Anthropic Claude 3 Haiku mannequin, this answer presents a streamlined and clever method to processing driver’s license information for underwriting guidelines validation functions. It automates varied duties, reduces guide effort, and enhances the accuracy and effectivity of the underwriting course of.

Stipulations

It’s essential to have the next to run the answer:

- An AWS account

- Fundamental understanding of the right way to obtain a repo from GitHub

- Fundamental data of working a command on a terminal

- Underwriting tips

Deploy the answer

You may obtain all the mandatory code with directions from the GitHub repo. Observe the directions within the GitHub repo README to deploy the answer.

Check the answer

To check the answer, add a pattern driver’s license to the underwriting doc bucket.

To search out the URL of the underwriting doc bucket, observe these steps:

- On the AWS CloudFormation console, select Stacks within the navigation pane.

- Select the stack GenAIUnderwritingValidationStack.

- On the Outputs tab, observe the worth for UnderwritingBucketURL.

To add the pattern driver’s license to the underwriting doc bucket, observe these steps:

- On the Amazon S3 console, navigate to the underwriting-document-bucket utilizing the UnderwritingBucketURL.

- Select Add.

- Choose the pattern driver’s license and select Add.

To assessment the workflow of the Step Features state machine, observe these steps:

- On the Step Features console, select State machines within the navigation pane.

- Choose UnderwritingValidationStateMachine and select View particulars.

- Choose the state machine and assessment the graph, occasion, and state views for extra particulars.

Clear up

After you check out the answer, observe the cleanup directions within the GitHub repo README to keep away from accruing prices.

Pricing

This answer consists of 4 main providers: Amazon Bedrock, Amazon S3, EventBridge, and Step Features. We focus on On-Demand Amazon Bedrock pricing on this put up. For the opposite providers, assessment the service’s pricing web page.

With On-Demand mode, you pay just for what you utilize, with no time-based time period commitments. For Anthropic Claude 3 fashions, you’re charged for each enter token processed and each output token generated.

As proven within the following graph, pricing varies for every Anthropic fashions: Claude 3 Haiku, Claude 3 Sonnet, Claude 3 Opus.

Claude 3 Haiku is Anthropic’s quickest, most compact mannequin for near-instant responsiveness. Claude 3 Sonnet strikes the best steadiness between intelligence and velocity—significantly for enterprise workloads. This answer makes use of the subtle imaginative and prescient capabilities of Haiku to course of photographs of drivers’ licenses and makes use of Sonnet to carry out RAG-powered rule validation of a driver’s license document in opposition to an underwriting guide doc.

Conclusion

On this put up, we explored the important and sophisticated challenges of doc understanding inside the underwriting course of for insurers. Manually extracting related info from applicant paperwork, validating adherence to underwriting tips, and offering clear justifications for choices is time-consuming and error-prone, and may result in inconsistencies. Generative AI and Amazon Bedrock supply a strong answer to assist overcome these obstacles. We mentioned how the reasoning and contextual understanding capabilities of generative AI fashions permit them to precisely interpret advanced paperwork and extract significant insights aligned with an insurer’s particular area data (corresponding to property and casualty, healthcare, and so forth) and corresponding tips. We supplied a reference structure that makes use of Amazon Bedrock FMs and RAG capabilities utilizing Information Bases for Amazon Bedrock, together with orchestration providers corresponding to Step Features, that permit insurers to enhance automation in key underwriting duties like guidelines validation.

Moreover, you discovered about how you need to use AWS generative AI options to extract related info, evaluate it in opposition to outlined guidelines, and flag any non-compliance points robotically. You should utilize this revolutionary method to enhance underwriting effectivity, cut back processing occasions, decrease human error, obtain equity and regulatory compliance, and enhance transparency with candidates. We confirmed how insurers can undertake generative AI and Amazon Bedrock to modernize their underwriting processes by means of clever doc understanding and automation, gaining a aggressive edge by means of mitigating dangers extra successfully.

Lastly, we provided a working answer with code you may deploy inside your sandbox atmosphere to speed up the event of your individual clever doc understanding answer utilizing AWS generative AI.

In regards to the Authors

Paul Min is a Options Architect at AWS, the place he works with prospects to advance their mission and speed up their cloud adoption. He’s obsessed with serving to prospects reimagine what’s doable with generative AI on AWS. Exterior of labor, Paul enjoys spending time together with his spouse and {golfing}.

Paul Min is a Options Architect at AWS, the place he works with prospects to advance their mission and speed up their cloud adoption. He’s obsessed with serving to prospects reimagine what’s doable with generative AI on AWS. Exterior of labor, Paul enjoys spending time together with his spouse and {golfing}.

Alfredo Castillo is a Sr. Options Architect at AWS, the place he works with Monetary Companies prospects on all elements of internet-scale distributed programs, and focuses on Machine studying, Pure Language Processing, Clever Doc Processing, and GenAI. Alfredo has a background in each electrical engineering and laptop science. He’s obsessed with household, know-how, and endurance sports activities.

Alfredo Castillo is a Sr. Options Architect at AWS, the place he works with Monetary Companies prospects on all elements of internet-scale distributed programs, and focuses on Machine studying, Pure Language Processing, Clever Doc Processing, and GenAI. Alfredo has a background in each electrical engineering and laptop science. He’s obsessed with household, know-how, and endurance sports activities.

Max Tybar is a Options Architect at AWS with a background in laptop science and utility improvement. He enjoys leveraging DevOps practices to architect and construct dependable cloud infrastructure that helps resolve buyer issues. His private pursuits lie round leveraging Machine Studying and Excessive-Efficiency Computing to assist resolve advanced issues confronted by Monetary Service prospects in Banking, Capital Markets and Life Insurance coverage.

Max Tybar is a Options Architect at AWS with a background in laptop science and utility improvement. He enjoys leveraging DevOps practices to architect and construct dependable cloud infrastructure that helps resolve buyer issues. His private pursuits lie round leveraging Machine Studying and Excessive-Efficiency Computing to assist resolve advanced issues confronted by Monetary Service prospects in Banking, Capital Markets and Life Insurance coverage.

Raj Pathak is a Principal Options Architect and Technical advisor to Fortune 50 and Mid-Sized FSI (Banking, Insurance coverage, Capital Markets) prospects throughout Canada and the US. Raj focuses on Machine Studying with functions in Generative AI, Pure Language Processing, Clever Doc Processing, and MLOps.

Raj Pathak is a Principal Options Architect and Technical advisor to Fortune 50 and Mid-Sized FSI (Banking, Insurance coverage, Capital Markets) prospects throughout Canada and the US. Raj focuses on Machine Studying with functions in Generative AI, Pure Language Processing, Clever Doc Processing, and MLOps.